Profit From The Panic In Oil

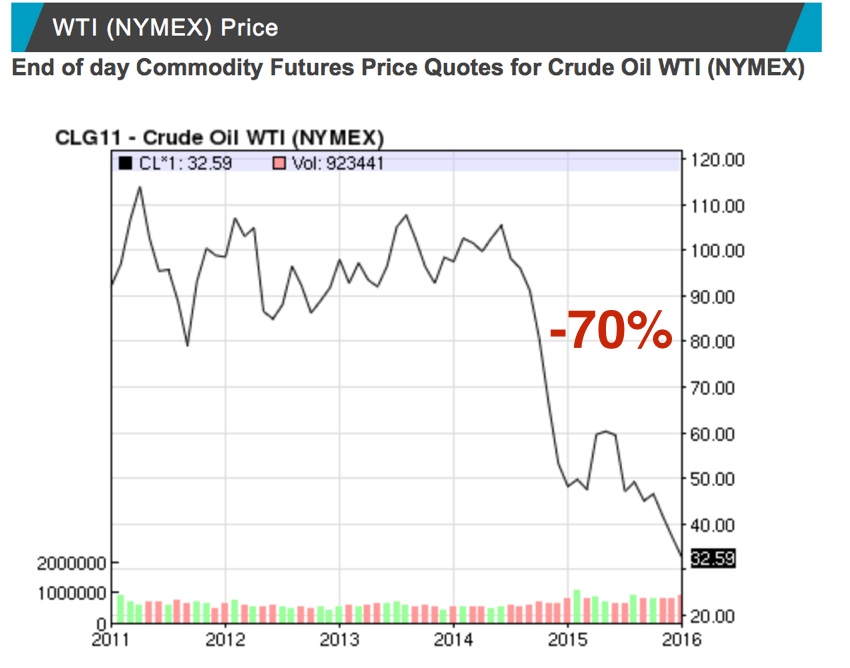

Oil Chart – Jan 2011 to Jan 2016

Oil prices have fallen 74% from its highs of $110 per barrel in 2011 to a low of $27 per barrel on 20 Jan 2016. A supply glut, coupled with weak demand (especially from China), have been the main factors. The rise of U.S. shale oil producers and the refusal by OPEC to reduce production and now recently, upcoming oil exports from Iran (after sanctions were lifted) have all contributed to the short term over supply of oil.

As of 22 Jan, oil has seemed to hit a potential bottom and has now rallied back up to $32. So, how long can oil stay at this level ($27- $32)? What wold it take for oil to rebound back to $60-$70 and even back to $100+ per barrel? Well, it all depends on when demand will suck up the existing oversupply of oil and this in term depends on when oil production start falling.

Oil production will start to fall as more and more oil producers go bankrupt and when OPEC (mainly made up of the Saudi Arabia + Arab States) agrees to cut their output. The reason OPEC has not been wanting to cut their production up to now is because they want these low prices to drive US oil producers out of business (especially the Shale oil producers) so OPEC can reclaim back the market share they have been losing. Of course, these low oil prices have also been hurting the Saudis as well (they have been suffering large current account deficits and have been selling other assets to finance their government spending).

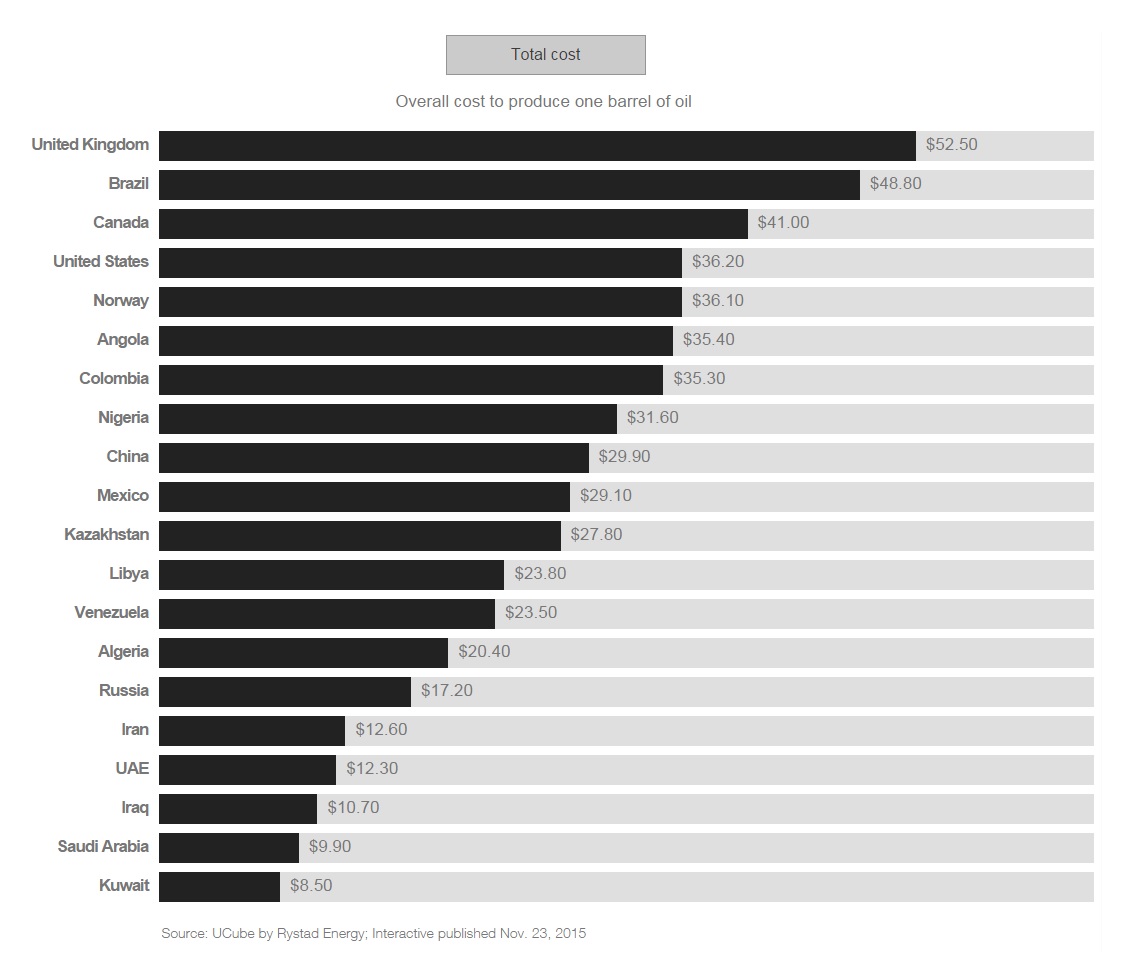

Let’s look at the cost of producing a barrel of oil:

Brazil $49

Canada $41

US $36

US Shale oil $70+

Saudi Arabia $10

At current oil prices, it is projected that half of US shale drillers will go bankrupt in the next 1-2 years. As for the Saudis, the IMF warned that most countries in the Middle East will run out of cash within five years if oil prices don’t rise above roughly $50 per barrel.

The bottom line is that there is a high probability that oil prices will eventually rise back above $50 a barrel and eventually back into the $90-$100 per barrel price range. This presents a potential opportunity for investors and traders to profit from the short term prices of oil.

Assets that Follow Oil Prices

So, how do investors/traders gain exposure to oil and profit from the potential rebound. There are a few ways:

The first approach is to go long on oil futures. Oil futures are covered in Conrad’s Pattern Trader Tutorial. Since, I don’t trade futures myself, I will rely on oil ETFs. There are many oil ETFs you can google and read about. The most traded ones are USO and USL You also have DBO, OLEM and OIL. These oil ETFs more or less track crude oil prices but it is not a perfect correlation as there are tracing errors due to the contango effect. In these respect USL seems to be a better instrument now. However, if you are a very short term trader (1-2 months trade), it should not matter that much.

2) Go long on Energy Companies

3) Go long on Energy ETFs

What is the Strategy?

Given that no one can predict the absolute bottom of oil prices and how long it will take for prices to rebound back to pre-crisis levels, what is the best strategy for managing risks and profiting from oil? There are two main strategies.

The second approach is to only enter when we have a confirmed uptrend in the oil ETFs and/or energy ETFs. This is when the 50MA crosses back above the 150MA and both MA and flat or sloping up (or when price crosses above 200MA. and 200MA sloping up). The advantage of this approach is you only enter when the uptrend moment is confirmed…. the downside is of course you tend to enter a higher prices than when the bottom is.

Below are the two videos I have created to share with you my insights.

Profiting from the Oil Crisis Part 1

Profiting from the Oil Crisis Part 2

If you are interested in enhancing your knowledge, do join us for a free today.

Other articles you might be interested:

Leave a Reply

Want to join the discussion?Feel free to contribute!